Introduction

Physical risks resulting from climate change can be event driven (acute) or longer-term shifts (chronic) in climate patterns. The impacts of physical risks are particularly pertinent to real assets given their long-life span and high initial cost. More specifically, buildings are vulnerable to climate change due to both location (e.g., in areas prone to floods, wildfires, and drought) and design (e.g., low resistance to storms).

To make more informed financial decisions real estate investors and lenders need to understand how climate-related risks and opportunities are likely to impact an organization’s future financial position as reflected in its income statement, cash flow statement, and balance sheet ( Figure 1) .

Note: Although the above depicts both transition and physical risks, this analysis will focus on the physical risks only .

The TCFD framework and IFRS S2 guidelines point to the growing requirement to consider climate risk scenarios and disclose climate-related risks and opportunities. However, to date there has been limited consistency across the investment community as to how climate data should be incorporated into valuations.

Furthermore, accounting and appraisal bodies have provided limited valuation guidance while recent regulation requiring certain institutions to perform climate scenario analysis allowed for simplistic financial modelling techniques. For example, as part of the 2022 Climate Risk Stress Test, the European Central Bank (ECB) allowed banks to use regulatory defined collateral haircuts for a flood scenario and macroeconomic shocks for a drought scenario.

Most recently, the U.S. Federal Reserve Board announced a Climate Scenario Analysis pilot in January 2023 that will allow banks to leverage more cutting-edge approaches towards measuring the financial impact of climate change – a huge step forward in incorporating climate data/science into calculating balance sheet exposure.

To establish a credible process for underwriting physical climate risks driven by the latest scientific climate data, the following steps should be considered:

Set-up the DCF

Investors should first calculate the industry standard discounted cash flow and include all data points required to make an accurate assessment of the value of a building or property. Once the initial assessment has been made, additional physical risk data points should be entered into a separate risk- adjusted assessment section.

By leveraging the data incorporated within climate risk assessments and analyzing asset and market trends within the last years, underwriters can obtain a greater degree of visibility and clarity surrounding the impact of climate volatility.

Perform Physical Risk Assessment

For each asset within a portfolio, a physical risk assessment should be performed that addresses both acute and chronic risks. Acute risks refer to those that are event-driven, including increased severity of extreme weather events, such as hurricanes, wildfires, and floods. Chronic risks refer to longer-term shifts in climate patterns (e.g., sustained higher temperatures) that may cause sea level rise, chronic heat waves, and drought.

Risk assessments typically assign a score for each asset to reflect its exposure and vulnerability to each physical risk. Risk scores serve as a useful tool to compare and rank assets within a portfolio; however, they should also inform which asset models need to be reviewed to account for additional risk. When an asset exhibits elevated risk related to any single climate peril, the investment team should seek to understand whether it's material, and if not now, when will it become material? Therefore, a forward-looking risk assessment is critical to understanding and managing climate risk appropriately.

Financial Statement Line-Item Mapping

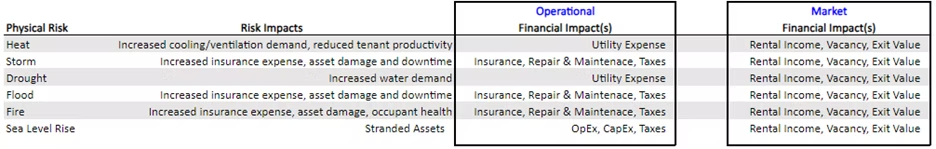

For each segment or sub-segment (property type and/or investment vehicle) within a portfolio, each physical risk should be mapped to the financial statement line-items that it impacts. For direct investment in commercial real estate, financial statement impacts generally exist in two forms: operational and market impacts.

Operational impacts are typically asset specific and represent a change to one or more of the financial statement line items that drive Net Operating Income (NOI). Examples of operational financial impacts include, but are not limited to, insurance, repair & maintenance, and utilities.

Market impacts represent long-term shifts that take place within a marketplace. The market impact looks beyond the direct impact to an asset and predicts changes that occur within a marketplace due to climate change. Market impacts should take into consideration items like migration patterns, infrastructure, and public spending to estimate changes to market average rental and vacancy rates and ultimately exit values.

Buyer beware: Financial impact should account for both direct and indirect impacts – otherwise, the financial impact only represents a narrow definition of impact. Note, however, that acute climate shocks such as floods and fires can have more severe financial impacts than chronic risks such as rising temperatures.

A sophisticated physical risk assessment will also provide investors with an estimate of the financial impact due to climate stress. However, there is a significant discrepancy between data providers as to how to calculate financial impact. In some cases, the financial impact represents an estimate of total damage in the event of a climate shock.

Forecasting Operational Impacts

For assets that exhibit a [elevated] level of risk related to any climate peril, asset managers should revisit key model assumptions, considering whether:

· The current level of income/expense per square foot or unit is appropriate given the risk

· The annual growth rate is still appropriate given the risk

· The timing/persistence of elevated growth (outpacing inflation) is reasonable

The real estate industry is underwriting an increase in insurance expense growth in years 1 and 2 (~10%-15%) followed by a reversion to the inflation rate (2-3% for years 3 -10). However, over the last few years insurance premium growth has significantly outpaced 10%-15% in many parts of the United States and continues to rise. To underwrite physical risk, the cost of insurance should proxy the underlying risk associated with the asset’s location. Repair & maintenance and utilities expenses can also be calibrated to the degree of location and asset risk.

Forecasting Market Impacts

As with operational impacts, data related to market impact can be quantified and included into this valuation modeling exercise. For example, declining demographics and poor infrastructure make a location less desirable on a forward basis, while increases in public investment (in areas such as transportation or public amenities) can conversely raise a location’s desirability. Measuring the climate adaptation interventions in a city or municipality – such as flood control measures or expanded renewable energy capacity – can also be factored in as a premium to a location’s implied valuation.

Evaluating the Implied Risk Adjustment

Taken together, both climate physical risk and asset and location resilience features can be quantified, scored and built into cash-flow forecasts and valuation assessments.

Climate Alpha is pleased to work with clients to apply its methodological insights to generate more accurate and reliable financial models for their portfolios. Feel free to contact us to set up a consultation.